What is the Formula for Cash Collection?

Home »

Understanding the components of the formula can better equip you with the knowledge needed to control your own cash flow. Now, you must multiply your collection rate for each bucket with the receivables balance from each bucket. To calculate cash collections from accounts receivable, you’ll first want to deduct any receivables you know to be uncollectible. This will leave you with your estimated collectible accounts receivable. Cash collection accounting is critical for any business to ensure that cash is received and recorded accurately. It generally involves tracking and reconciling customer payments with outstanding invoices, identifying discrepancies, and taking appropriate actions to resolve any issues.

- You’ve delivered a product or service, and now you’re just waiting – and sometimes, endlessly chasing – to get paid.

- So, the payments for sales made in January will be collected in April, those in February in May, and so on.

- The cash collection cycle should be kept as short as possible, because rapid collection means more cash on hand, which reduces a company’s borrowing requirements.

- After gathering your data, it’s time to determine the portion of your total sales that were made in cash.

- However, collection agencies usually charge a substantial fee, so try all other alternatives first.

Cash Collection Process

Monitor operating cash flow KPIs using analytics tools while optimising your accounting, accounts receivable and cash management operations. Expected cash collections refer to the total amount of payments that you estimate will be collectible from customers. This can be through cash sales, accounts receivable, or other sources of revenue. The first customer pays immediately upon delivery of the goods contributing to your cash sales. The second customer takes a line of credit and pays you 60 days after the invoice is sent. In both cases, you have collected cash from customers; while the method might differ, both constitute cash collections.

Days Payable Outstanding (DPO)

This is where things get tricky – as actually calculating accounts receivable is the easy part. And if manually calculating these seems cumbersome, stay tuned – we’ll introduce you to a platform that can streamline and automate the where is my stimulus payment process for you. First, let’s talk about what to do with accounts receivable after calculating it. Conversely, a well-managed AR showcases a business that’s adept at balancing customer relationships with robust financial health.

Streamline your order-to-cash operations with HighRadius!

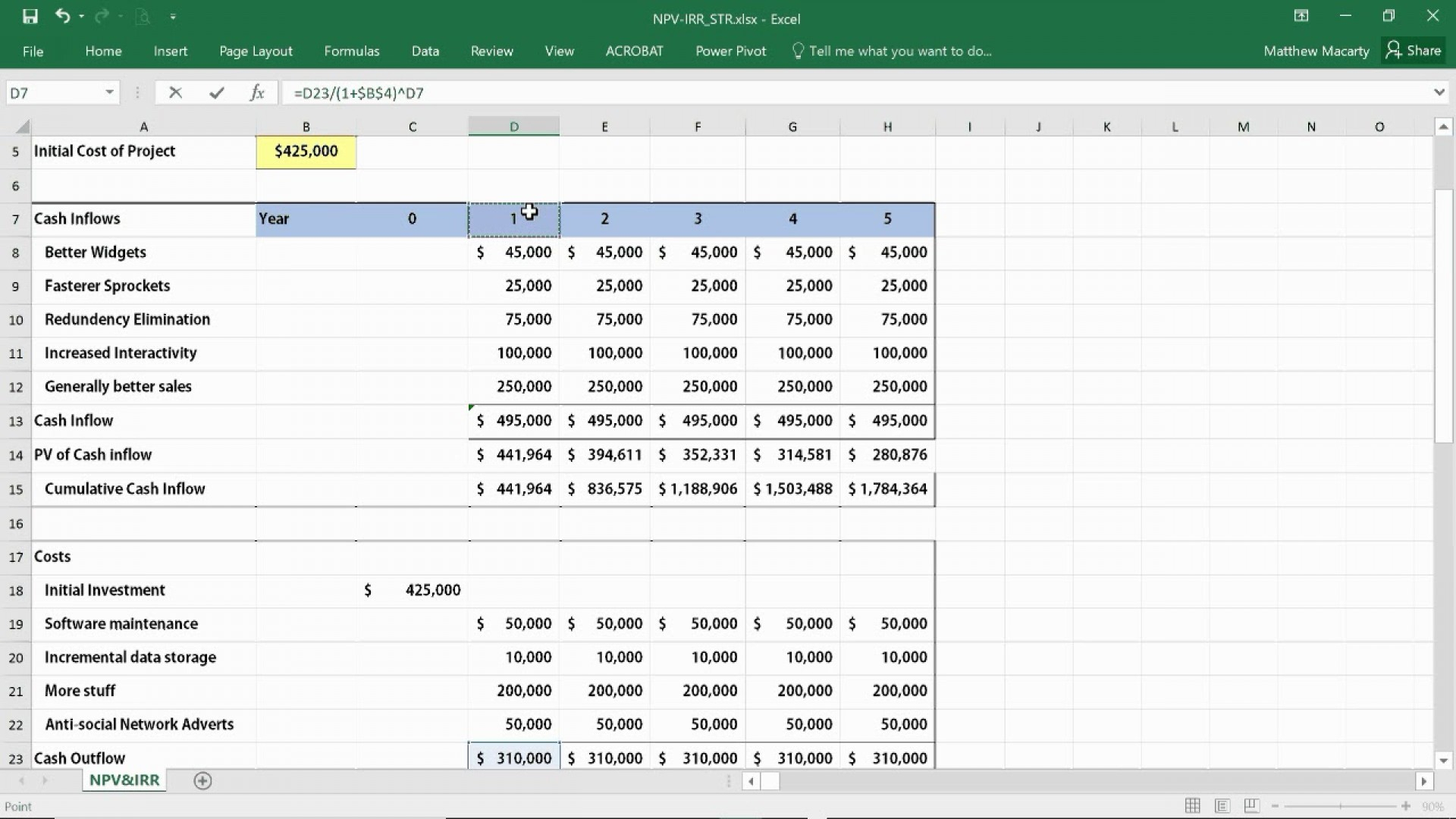

However, today, there are numerous ways in which these challenges can be tackled. Cash drives business functions; therefore, collecting the money owed to your company for goods and services provided is essential for various reasons. Learn how Versapay helped our clients improve one of the most important ones, achieving a 305% ROI. Budgeted collections from the 30-day receivable group are $5,000 multiplied by 0.6, or $3,000.

Why effective cash collection is vital for business success?

However, this can be quite time-consuming; you can, therefore, incorporate a cash application management tool that will do the heavy lifting for you in seconds. Problem – Sometimes, your customers might go bankrupt or be unable to pay back the debt they own. This can lead to a loss of revenue or expensive, time-consuming efforts to retrieve the money through legal actions. Cash collection can be a strenuous process involving many complicated and time-consuming challenges.

What is an example of a cash collection?

It’s a useful metric for assessing a company’s ability to convert sales into actual cash. Consistent communication is critical to ensuring customers pay on time. Send regular follow-ups, maintain a friendly but firm tone, and have a straightforward escalation process for late payments.

Collections from the 60 to 90 group should be $5,000 multiplied by 0.3, or $1,500. Collections from the 90 to 120 group should be $5,000 multiplied by .1, or $500. You can make better business decisions by tracking forecast variations over a given period.

This provides a detailed timeline of when your credit sales will translate into cash inflows. The calculated cash collections provide companies with insights about the collected revenue. This data plays a crucial role in financial planning, helping determine future sales forecasts, budget allocations, operational improvements and capital investments. In this blog we will help you understand the importance of cash collections, how to calculate it, and the solutions to challenges many businesses face with cash collections. The collection of funds is a fundamental aspect of cash flow management.

It also enables a company to plan and budget effectively, make informed financial decisions, and ultimately achieve financial stability. In business, having an accurate understanding of cash collections is crucial for maintaining a healthy cash flow and ensuring financial stability. Cash collections are the sum of all cash received from customers, including payments for products or services, as well as any other inflows of cash.

Many successful companies employ a combination of traditional and creative methods to ensure steady cash inflow. From there, you’re able to compare your cash collections ratio over different periods or to different segments and determine where changes need to be made. Below, we’ll break down some essential equations to help you master AR’s various facets. That being said, let’s start with the basics – how to calculate average accounts receivable. When calculated correctly, it provides insights into cash flow – the very essence that fuels a company’s operations.

And finally, an invoice is generally more difficult to collect the longer it remains outstanding. Once you’ve chosen a set of operating cash flow KPIs to track, periodically assess whether they give you a complete picture of what you’re looking for. If they don’t, you must consider which metrics must be added to your tracking tool and which can be removed.

CONTACT US