Exactly what offers otherwise masters was single parents permitted?

Home »

Most people cut for a long time as well as have making sacrifices in the process. It’s so much more difficult having unmarried mothers who’re support youngsters.

Help save a giant deposit

So it tunes apparent but putting away as much money since you is means you may have much more security throughout the possessions you need to purchase, definition it’s not necessary to obtain as much.

If you https://paydayloansconnecticut.com/mashantucket/ find yourself around forty and want to buy your very first house, beginning a lifestyle ISA will provide you with as much as ?step 1,000 off 100 % free money every tax year. This is how brand new Lifetime ISA really works.

Get a mortgage broker

Good mortgage broker can help you decipher hence lenders are most likely to provide home financing.

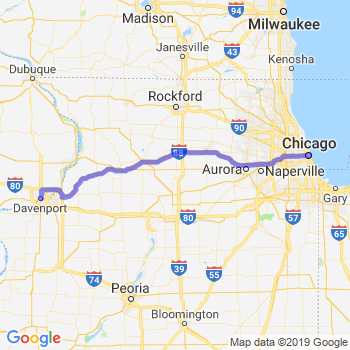

As you can plainly see throughout the table above, loan providers take an incredibly some other position about precisely how it assess certain brand of income.

They’re able to and additionally keep your own hand from the financial processes which are going to be indispensable, particularly when you may be a busy functioning parent.

If you’re weigh right up whether to get a brokerage, check this out. Remember you can find free financial advisers also. I checklist the top-ranked ones right here.

Play with a national design

Shared control will work for american singles which can’t afford so you’re able to undertake a giant mortgage. This strategy lets these to buy a share of the home and pay rent to the other individuals.

People buy a percentage of anywhere between twenty-five% and you will 75% of your property’s worth. Keep in mind you’ve kept to store a deposit on the mortgage.

- To purchase away its ex lover-mate (more on you to right here)

- Trying out a full mortgage payments

- Most of the home debts

The lending company must be came across that changing the mortgage of combined brands to at least one one to are nevertheless reasonable, which is where many unmarried parents find challenge.

David Hollingworth out-of L&C home loans told you: Value is paramount question. Even with an easy to understand want to stay-in the modern family home, it may not feel you’ll be able to on long term.

Keeping the family domestic may require one another ex lover-lovers to remain into mortgage, in the event one of these will continue to live around. However, so it constantly isn’t you can possibly because many people wouldn’t want to be named for the a home loan when they’re zero extended living in a property.

It is also tricky and much more expensive to purchase an excellent house when you’re getting called towards the a different sort of given that commercially you’d be to shop for a moment assets. To put it differently, loan providers will have to evaluate your revenue more than two mortgages.

Because of this, Hollingworth told you ex-partners usually ily the home of release equity to each and every partner, providing them with each other a deposit with the a different sort of possessions.

But that can perhaps not eliminate the cost pressure using one mother or father, this is the reason Hollingworth told you it’s more significant than before so you’re able to ensure that as frequently money that one may is factored in to contain the mortgage.

It certainly is a good idea to make sure you are providing benefit of any possible savings to relieve the new monetary load, such as for example once the group are currently wading compliment of a repayment off way of life crisis.

Council income tax dismiss

There is a 25% council income tax discount available to people that either alive by yourself or who’re the sole mature residing in their house.

With council taxation broadening in the most common places in the British, make sure to make use of this to save your self numerous from lbs over per year.

Child work with

Be certain that you’re saying the bucks getting child benefit, that provides your ? weekly to suit your basic youngster and you may ? for everybody more pupils.

CONTACT US