5 4: The Contribution Margin Income Statement Business LibreTexts

Home »

It focuses on the sales of individual products and how much each one contributes to covering the company’s fixed costs (like rent) and then making profit. This number is super important because it helps businesses decide which products are worth selling more of and which might be losing money. It considers the sales revenue of a product minus the variable costs (i.e., costs that change depending on how much you sell), like materials and sales commissions. As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making. In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit.

6: Contribution Margin Analysis

Regardless of how contribution margin is expressed, it provides critical information for managers. Understanding how each product, good, or service contributes to the organization’s profitability allows managers to make decisions such as which product lines they should expand or which might be discontinued. When allocating scarce resources, the contribution margin will help them focus on those products or services with the highest margin, thereby maximizing profits.

- Therefore, it is not advised to continue selling your product if your contribution margin ratio is too low or negative.

- The same thing goes with fixed expenses; they must be included in fixed costs if they are fixed.

- And to understand each of the steps, let’s consider the above-mentioned Dobson example.

- The contribution margin is $145,400, and the contribution margin ratio is 45.4% ($145,400 / $320,000).

Example 1 – single product:

However, these fixed costs become a smaller percentage of each unit’s cost as the number of units sold increases. However, the growing trend in many segments of the economy is to convert labor-intensive enterprises (primarily variable costs) to operations heavily dependent on equipment or technology (primarily fixed costs). For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s. Since machine and software costs are often depreciated or amortized, these costs tend to be the same or fixed, no matter the level of activity within a given relevant range. Management uses the contribution margin in several different forms to production and pricing decisions within the business. This concept is especially helpful to management in calculating the breakeven point for a department or a product line.

How do you calculate EBIT and EBITDA on an income statement?

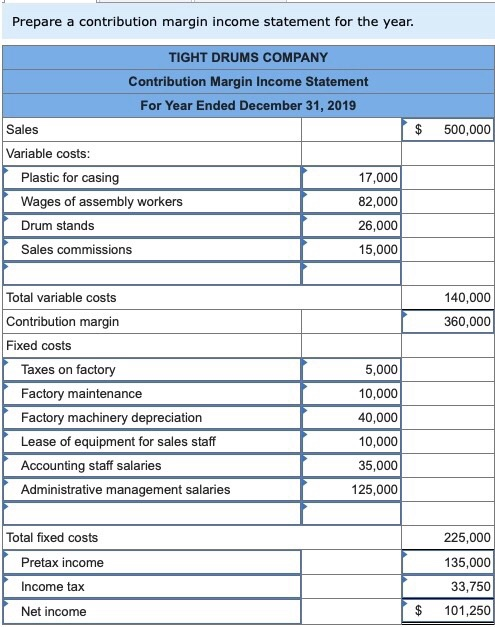

By doing this, we see the gross profit margin, which helps businesses decide on pricing and how to manage costs to generate more money. This step is part of creating a contribution margin statement, which is a type of profit and loss statement. It shows us the money made from selling products or services after covering the costs to make them. This statement highlights the importance of managing regular income, operating income, and the costs involved in making products or services. In a contribution margin income statement, variable cost of goods sold is subtracted from sales revenue to obtain gross contribution margin. The variable marketing and administrative expenses are then subtracted from gross contribution margin to obtain contribution margin.

In May, \(750\) of the Blue Jay models were sold as shown on the the only three reasons entrepreneurs need accounting and finance. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year. Thus, the contribution margin ratio expresses the relationship between the change in your sales volume and profit.

Fixed selling and administrative costs totaled $50,000, and variable selling and administrative costs amounted to $200 per unit. The first step to calculate the contribution margin is to determine the net sales of your business. Net sales refer to the total revenue your business generates as a result of selling its goods or services.

Contribution margin analysis is a valuable tool for monitoring financial health over time. By tracking changes in contribution margins alongside key performance indicators, businesses can quickly identify trends, spot emerging challenges, and capitalize on opportunities. This proactive approach to financial management enables timely interventions to steer the company toward its economic objectives. Say, your business manufactures 100 units of umbrellas incurring a total variable cost of $500.

The formula to calculate the contribution margin is equal to revenue minus variable costs. Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation or shipping costs (variable costs). These costs may be higher because technology is often more expensive when it is new than it will be in the future, when it is easier and more cost effective to produce and also more accessible. A good example of the change in cost of a new technological innovation over time is the personal computer, which was very expensive when it was first developed but has decreased in cost significantly since that time. The same will likely happen over time with the cost of creating and using driverless transportation.

These costs don’t fluctuate with the level of production or sales an item makes—which is why they’re sometimes called fixed production costs. No matter how much a company sells, the office rent still needs to be paid—so this is a fixed cost. The contribution format income margin is essential for understanding the financial performance of individual products or services and is used to make informed decisions about pricing, production, and cost management. A key characteristic of the contribution margin is that it remains fixed on a per unit basis irrespective of the number of units manufactured or sold.

The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction.

CONTACT US