2. Learn Your credit score and you can Records

Home »

Refinancing their home loan to help you prolong the phrase can also end in using a great deal more desire over the life of the loan. Even if you switch off a varying-rate home loan in order to a fixed-rates mortgage, a longer term you will definitely indicate spending much more attention and value a great deal more full.

Missed Repayments Is Damage Your Borrowing from the bank

Refinancing the mortgage does not always mean you might immediately prevent purchasing on the your mortgage. Forgotten a repayment on your own newest home loan inside the refinancing procedure may affect your credit score. Its important to continue using the dated financial up until the equilibrium has reached zero.

Step-by-Step Guide to Refinancing The Mortgage

Do you believe refinancing may be the right decision to you? Because you have started from the means of securing a mortgage, the procedure of refinancing might be familiar.

Mortgage refinancing basically takes between 31 and you can forty-five months so you can over, even though this schedule can differ notably. The method may become more drawn out if you’d like businesses so you’re able to appraise or check always your residence. Just how long new refinancing processes takes hinges on your financial situation and your residence’s worth.

step 1. Learn Your financial Costs

Wisdom debt prices for refinancing is essential for deciding if refinancing is definitely worth they. The expense of mortgage refinancing usually boasts:

- Application charge

- Origination costs

- Assessment costs

- Check costs

- Settlement costs

To choose if the a lower rate of interest makes it possible to get well the expenses your happen due to refinancing, you will understand the particular monetary costs. https://paydayloancolorado.net/westcreek/ While you are reducing your interest rate, however also are restarting a new 30-year financial, do you realy finish using furthermore the term of the mortgage? Can it sound right to you economically to blow alot more inside the total along side title of your financing in the event it means you are expenses less monthly? The fresh discounts should provide more benefits than the costs about how to go after refinancing your mortgage.

It’s also advisable to expose a very clear goal for refinancing your own mortgage – if your need are reducing the loan title, lowering your payment per month or tapping into your house collateral to have personal debt payment otherwise home repairs.

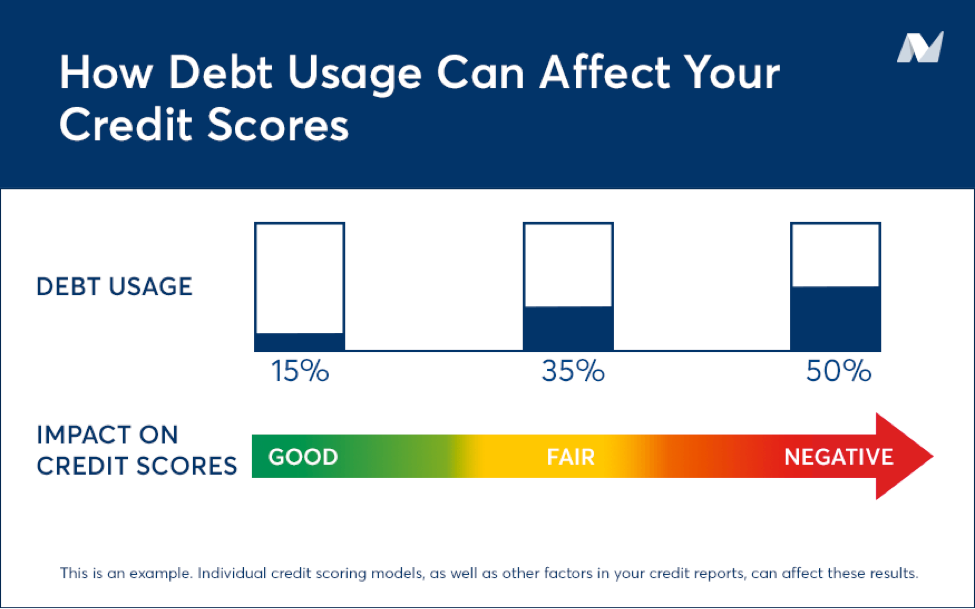

That have a good credit score and you can credit history could offer good large amount of rewards, specially when you’re interested in refinancing their mortgage. Good credit facilitate your odds of approval for a good financial refinance and just have find just what rate of interest your own financial will end up being willing to promote.

The greater your credit score is actually, the lower your interest rate might possibly be. If your credit rating provides reduced because you received your current mortgage, refinancing may not be advantageous to your. In case the credit rating has enhanced subsequently, refinancing your own home loan is useful.

To determine exacltly what the credit history are, you should check your own FICO score free-of-charge. When you learn your rating, you could dictate what your location is for the adopting the credit rating categories:

- Very poor: 300 so you can 579

- Fair: 580 so you’re able to 669

- Good: 670 to 739

- Decent: 740 to 799

- Exceptional: 800 in order to 850

A mortgage lender may agree your application so you’re able to re-finance should your rating was at minimum 620, however, an excellent otherwise exceptional get is far more likely to allow you to get a decreased prices. Along with your credit history, their lender can also consider carefully your credit rating, borrowing application ratio, previous borrowing applications, foreclosures and you may bankruptcies.

Checking your credit report will allow you to guarantee you can find no discrepancies. If you learn things in your credit history that’s wrong or fraudulent, you could potentially argument it to the credit reporting agencies. While you are calculated as correct, the incorrect product would be eliminated or repaired. This can make it easier for you to find a better interest rate for your this new mortgage.

CONTACT US