According to the financial, other loans can get additional credit history criteria

Home »

But, generally, your credit rating have an enormous impact on simply how much you is also acquire, what kind of financial you can purchase and you can just what terms you will be given.

Lenders often normally pull your credit rating to possess a great preapproval so you’re able to assist determine the creditworthiness. Therefore, before applying getting an interest rate preapproval, feedback your credit report to see chances to alter your score. Certain ways to raise otherwise keep credit history is:

- Purchasing your own bills on time

- Paying credit card debt

- Disputing inaccurate affairs

- Perhaps not making an application for the fresh new borrowing account

- Taking extra as an authorized user towards a credit card holder’s account

Particular lenders let home buyers which have bad credit scores go into the actual estate industry. Federal Houses Government (FHA) mortgage loans, Agencies of Experts Things (VA) mortgages and you will U.S. Institution of Agriculture (USDA) financing routinely have even more easy borrowing criteria and you will, in some cases, don’t need an advance payment.

cuatro. Add an effective co-signer

It is a huge inquire, you might possibly improve preapproval number by the delivering some one your believe to co-signal the borrowed funds. Whether your co-signer have good credit and you may a stable earnings, loan providers you are going to raise your preapproval limit centered on their mutual income.

But co-signing do feature specific threats. The new co-signer try lawfully in charge to settle the loan if you fail to. The mortgage and its percentage records are registered on co-signer’s credit report.

5. Make more cash

One method to manage a bigger home loan is always to increase money. That might feel like an increase working, overtime otherwise a higher-purchasing employment. These are typically the feasible alternatives, however, many of these are easier said than done for most of us.

- Income away from rental properties

- Attention otherwise dividends of financial investments

- Earnings out of alimony or child assistance

- Money generated of a member-time business or front hustle (Etsy, individuals?)

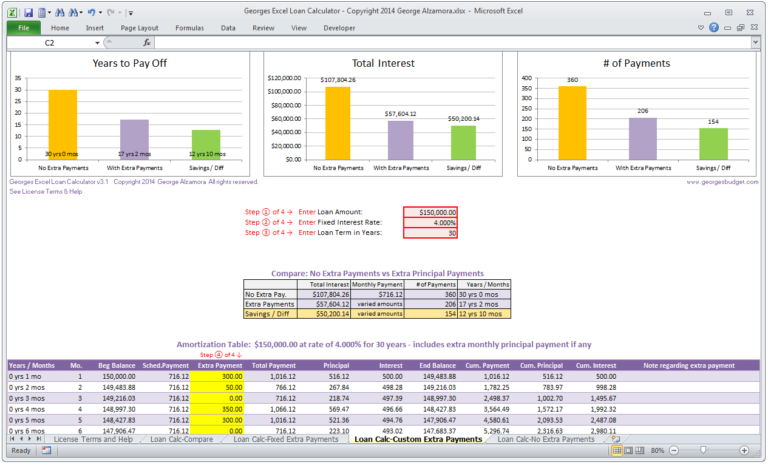

six. Score an extended-label mortgage

Since idea of repaying your own mortgage inside ten or 15 years has some attract, the fresh new month-to-month mortgage payment to own smaller-name fund may well not benefit your financial budget. By getting a lengthier financing label, like 3 decades, you could expand the home loan repayments and likely end up getting economical monthly installments.

Lenders need to make yes you can keep up with your own money, so down monthly obligations over a longer label ount. You should know one stretched-identity funds are apt to have higher interest rates. Fundamentally, you will likely spend a great deal more for your financial than you’d that have a smaller-name loan.

You may want to offset a top financial rates and relieve your general costs by simply making large or a lot more costs over the life of your residence loan.

Professional idea: Look at your mortgage arrangement beforehand while making larger otherwise additional money. Particular https://paydayloancolorado.net/idledale/ mortgage loans come with prepayment penalties.

eight. Look for a unique bank

You may find moderate differences in underwriting standards round the loan providers. If you aren’t pleased with the mortgage preapproval in one financial, you could potentially comparison shop that have multiple loan providers to see which one to offers a much better preapproval count and you can terms and conditions.

8. Decrease your domestic to purchase finances

If you’re unable to improve your financial preapproval otherwise commonly happy to go through the procedure of optimizing your finances, you may have to start looking getting a cheaper house. You could potentially nonetheless be a homeowner, you’ll only have to get a hold of your dream household inside a more sensible spending budget.

Look for cheaper properties and you may revisit your house must-haves list. Was indeed every one of these business need-haves? Is it possible you inhabit another city, do an inferior yard become end around the globe, were there several condo amenities you might live in the place of? There are lots of a method to build homeownership sensible when you find yourself selecting property that suits your needs.

CONTACT US