Cash flow statement template download for Excel Sage Advice US

Home »

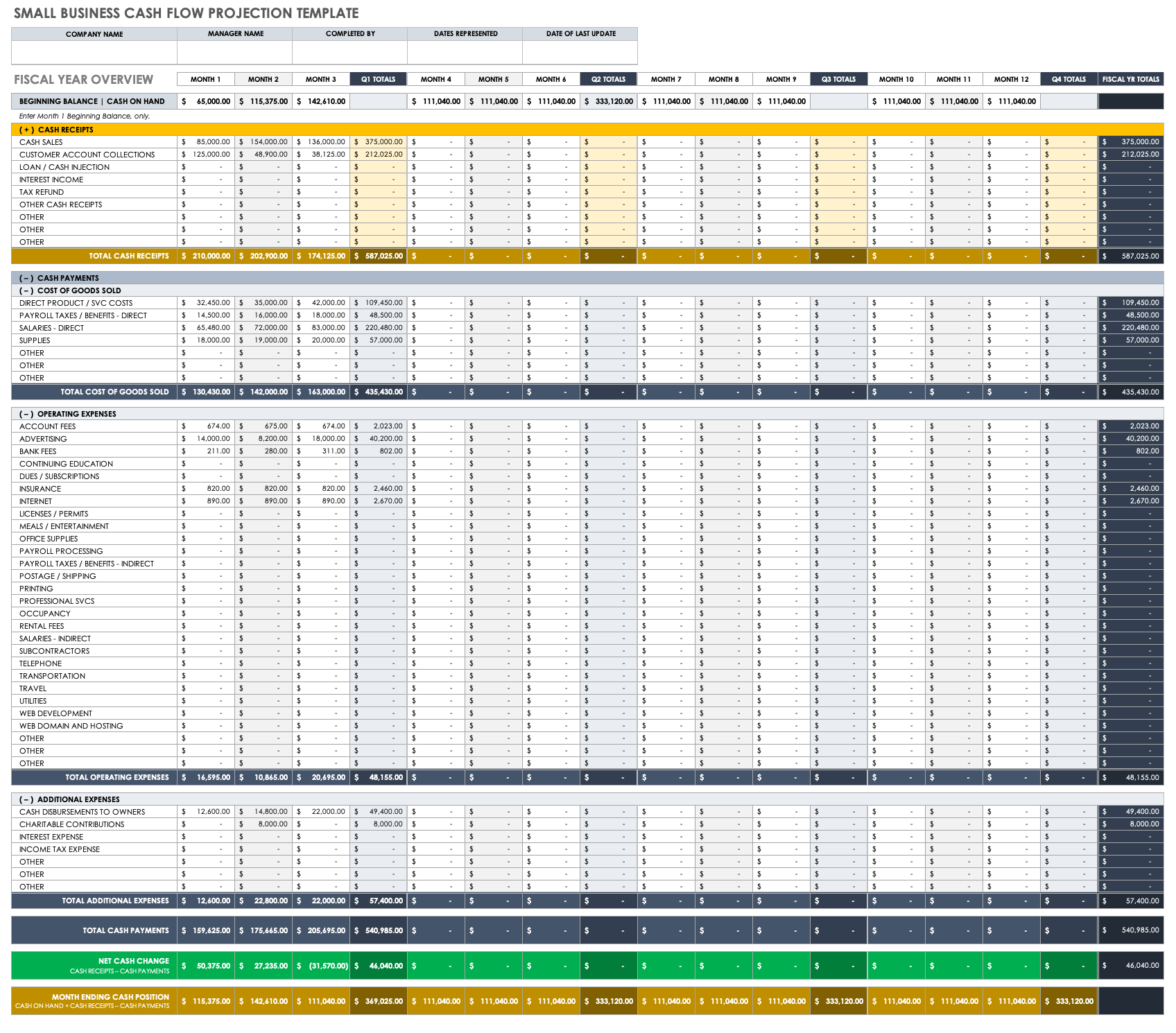

Each month has a separate sheet so that you can get a thorough picture of cash inflows and outflows for both short- and long-term periods. In this post, we have compiled a list of the 17 best free cash flow templates in Google Sheets. These Google Sheets cash flow templates are designed to simplify your financial management process, providing you with a clear picture of your business’s financial health.

Restaurant Cash Flow Template

Yes, you can use an Excel cash flow template to help you create a cash flow statement. Download QuickBooks Excel cash flow statement template to assist you in preparing your cash flow statement quickly and efficiently. Our template includes formulas and formatting tailored for cash flow analysis. Download QuickBooks’ cash flow statement template no matter what type of business you have.

Cash & Cash Equivalents

The classification of these receipts must be consistent between reporting periods. This figure should equal the closing balance from the previous reporting period. Integrate your Wise business account with Xero online accounting, and make it easier than ever to watch your company grow. Users of these templates must determine what information is necessary and needed to accomplish their objectives. Overall, this efficient and intuitively structured template caters to the needs of hotel owners, helping them make informed financial decisions for their business’ growth and sustainability.

steps to prepare a bank reconciliation statement

Ideal for both individuals and businesses, these templates offer a simple way to get a quick snapshot of your financial health. Built for use in the cloud-based Google Sheets platform, these templates come with pre-configured formulas to automatically calculate key metrics like net cash flow. A cash flow statement is a financial document typically used to understand the solvency of your business. When combined with other financial statements, it can give you a clear view of the financial health of your small business.

Use the quarter-by-quarter tabs to quickly detect any problems with a variety of factors, such as late customer payments and their potential impact on your business. This quarterly cash flow projections template is perfect for determining how any given variable might affect future financial planning. The indirect method is slightly more complex as it uses your company’s net income and then calculates depreciation. Non-cash items that are taken into account include depreciation, amortisation, account receivable loss provisions, and losses from the sales of fixed assets. The cash flow statement shows changes in your cash on hand, including cash in your bank account and short-term investments that you can easily convert to cash.

Why Do Businesses Need Cash Flow Statements?

It also factors in non-cash income items and balance sheet accounts like stock and capital. In addition, the template includes a check section, allowing you to verify the accuracy of your cash flow data by comparing it with the profit and loss by day and the balance sheet by day. The cash free donation invoice template inflow section allows you to select profit and loss accounts and balance sheet accounts from the dropdown menus, making it easy to categorize your income sources. You can input estimates and actuals for each account, and the template will calculate the total cash inflow for the week.

- However, IAS 7 requires companies to maintain consistent classification between reporting periods.

- These details provide an accurate picture of your company’s projected month-by-month financial liquidity.

- The statement of cash flows, and the free cash flow calculation are tools you can use to manage your business.

- This is the perfect template for you if you’ve been wondering where your money is going lately.

- Simply enter the financial data for your business, and the template completes the calculations.

Gathering data from separate spreadsheets gives you more accurate data and complete access control. The template also calculates your cash-on-cash return on investment, giving you a clear picture of the profitability of your Airbnb property operation. Staying on top of your investments can be a real challenge, particularly if you manage them… It is also a crucial tool to keep tabs on outgoing cash and great for spotting unnecessary spending.

This spreadsheet can be accompanied by other Vertex42 financing templates, such as their income statement and profit loss projection templates. That means it’s important to effectively track everything flowing in and out of your accounts. There are tried and tested ways to achieve this, read on to discover the top 6 best cash flow templates. As two of the three main types of financial statements, both cash flow and income statements offer insight into a company’s financial performance.

The term “cash” refers to both income and expenditures and may include investments and assets that you can easily convert to cash. To help you get started creating a cash flow statement or forecast, we’ve included a variety of customizable templates that you can download for free. Simply adjust your chosen template to fit your specific goals and the intended audience. Each template offers a clean, professional design and is intended to save you time, boost efficiency, and improve accuracy. Just enter your financial data, and the templates will perform automatic calculations for you to analyze. By combining your cash flow statement with a balance sheet, income statement, and other forms, you can manage cash flow and get a comprehensive understanding of business performance.

CONTACT US